Sorry to have been away so long, but some times life gets in the way of working – sort of. Despite having a reputation for always speaking my mind, unlike some bloggers, I don’t think I should say something simply to be saying something. There is a good deal of useless comment floating around the internet – just read much of the tripe being spewed out on Twitter every day, particularly by politicians who fear that the electorate might forget who they are unless they put out a bit of useless babble every 24 hours. It is quite amazing that Bo-Jo, with an ego bigger than the great outdoors, does not Tweet. Then again he probably would like to get out of the glare of the spotlight once in a while, unlike his model, the President formerly known as The Orange Peril, who fed the trough daily.

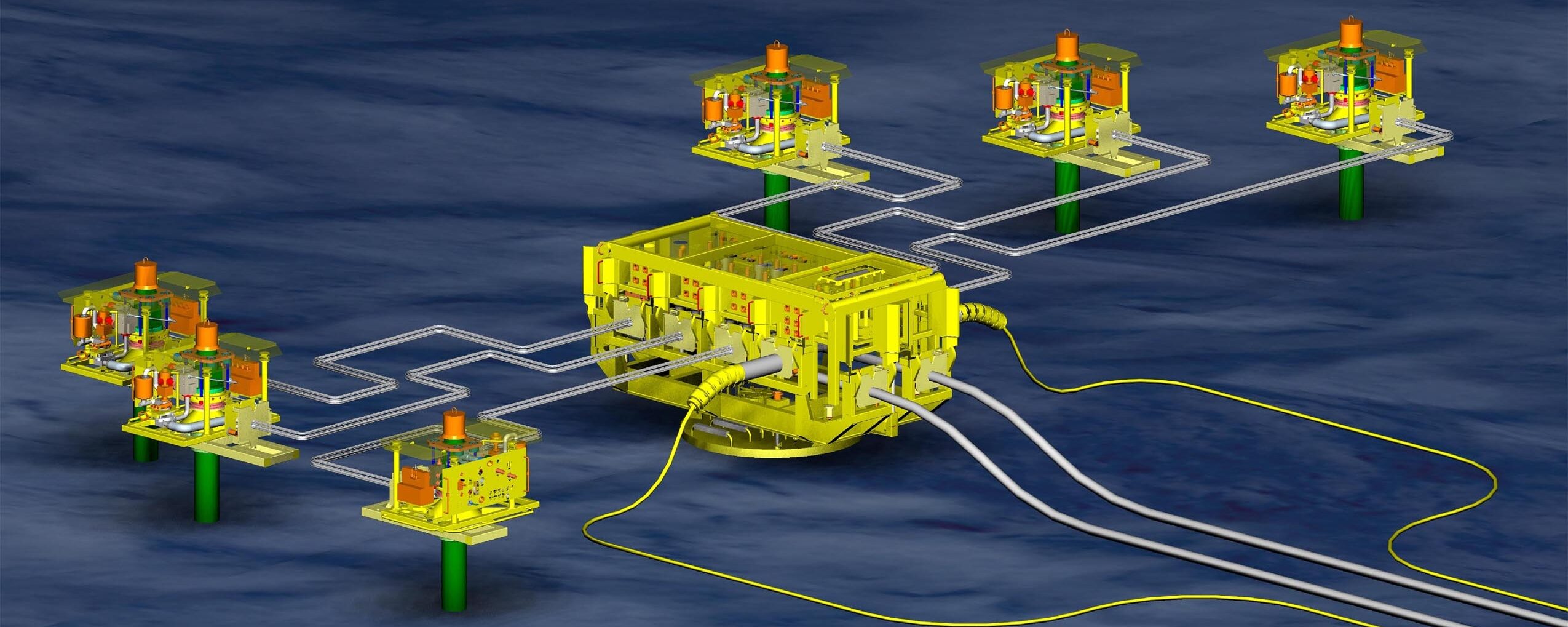

Now onto something of note. There was a most interesting commentary recently from Rystad Energy, a consultancy which is never short of something to say. It analysed current cost and spending trends and has focussed on the fact that the cost of subsea developments is set to skyrocket with Norway, the biggest market for subsea tiebacks ($55bn through 2026) in the world, is set feel the weight of $2.2bn in extra costs.

Some may recall the state of the subsea market back in the spring of 2013. An exec from one of the American independents, speaking during a panel discussion at OTC, bemoaned the over-heated marketplace for subsea hardware and installation operations at a time when the price of oil was around $100/bbl. He suggested that prospects which in the past easily cleared the threshold for economic viability were now looking like marginal developments. Then, 18 months later, mid-autumn 2014, the oil price crashed and sent the marketplace into a tailspin that did not stop for several years.

So are we about to have a repeat of the 2014 crash? With the price of Brent crude today (Wednesday, 26 February) hovering just below $90/bbl, it does look a bit like deja vu all over again. Rystad pointed out that subsea hardware for Norwegian Continental Shelf projects had already risen by 10% in the last 18 months and there were expected price shocks coming on material and labour plus forecast rise in the cost of drillling and related equipment.

What did not exist back in 2013 – or, more specifically, no one was paying attention – was the issue of climate change and the various activities related to renewable energy, hydrogen production, carbon capture and the like. With much funding going towards these activities and activist investors pushing the boards of big hydrocarbon companies to change tack, it looks like there could be another crash coming.

But wait – what about the Ukraine and Russian attempts to blackmail Western Europe with threats to shut down gas pipelines? And then there is concomitant issue of inflation? So many problems and we have Sparky The Clown at the head of the government. I may not be a Tory voter, but it would be nice to have an adult, not a party animal, in charge.