I was at the Natural Resources Forum event in London recently which was a ‘talking heads’ on the future of the North Sea. One topic of focus was decommissioning and I was quite surprised to hear one of the speakers talking about ‘monetising’ the value of decommissioning.

This seemed not to be about the business opportunities for contractors, but for potential licence holders making money out of owning assets about to be decommissioned. Huh? I have to admit that it did not make much sense to me. What did, though, was the idea, put forward by a BP man, that the cost of decom could come down by up to 35% once more lessons were learned and better practice put in place, particularly if North Sea operators latched onto some of the experience from the Gulf of Mexico, where abandonment work has been going on for much longer.

With decom in mind, I found it most intriguing that a relatively new company, Well-Safe Solutions, has actually bought an older semi, Ocean Guardian, for use in the well abandonment market. This is quite a bold move for a newcomer only two years in the business, athough with an experienced management team. It is reportedly spending $100mn on the rig and its upgrade, which includes equipment allowing it to launch a subsea lubricator, as part of a $270mn investment programme. It has also started five plug-and-abandonment clubs aimed at spreading the cost of deploying equipment and reducing costs through experience.

Strangely enough, Well-Safe is also quoting the aim to reduce costs by 35%, an odd number to have latched onto.

***************************************************************************************

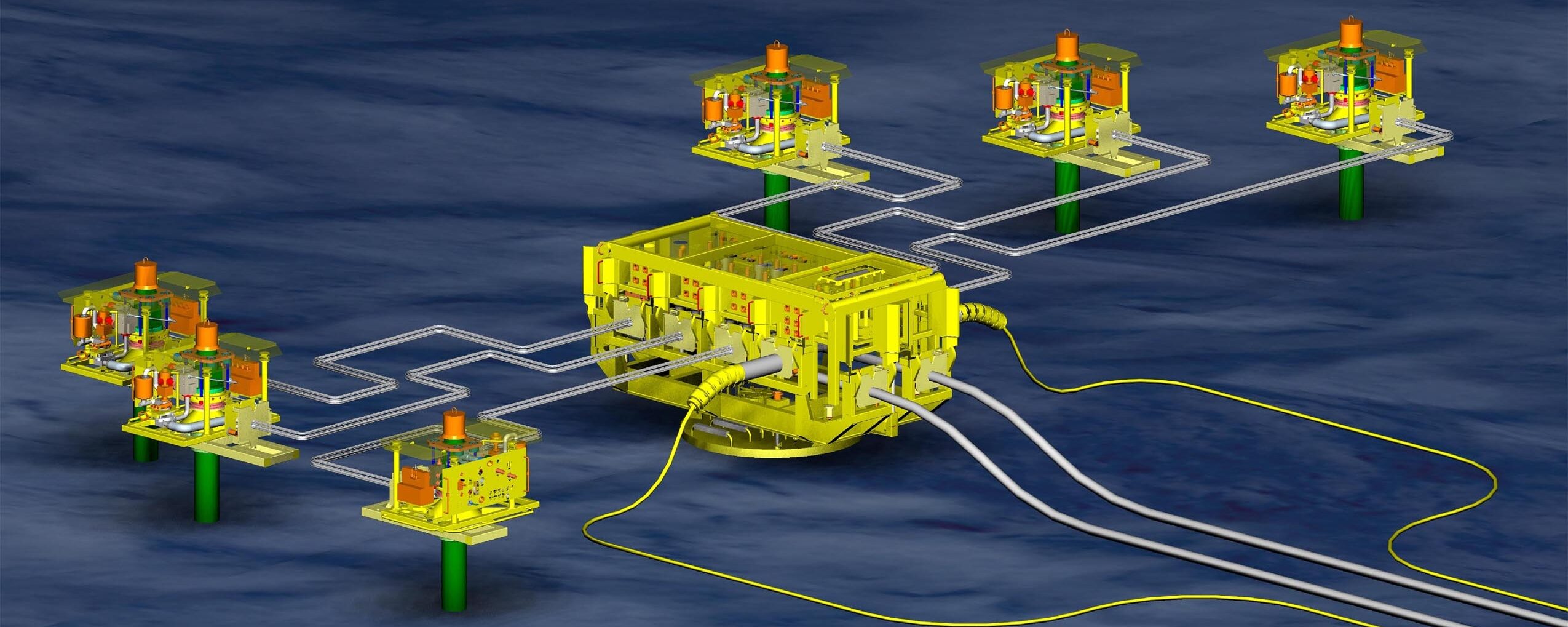

It is interesting to note a number of recent subsea project contract awards that have gone to hardware/installation contractor alliances – Onesubsea/Subsea 7 and BHGE/McDermott, for example – which do not even include those won by TechnipFMC which is an ‘alliance’ all on its own.

The idea of such joint ventures is, of course, nothing new. They go back at least to the late 1980’s, but they were never a big, or even a small, success. I believe that is because back in the day, the operators saw these groupings as an attempt to force them to choose companies they did not want to work with or take decisions that were being foisted upon them. Operators like to call the tune as all supply and service companies know too well.

It seems that only the need to find ways to reduce project costs by, for example, reducing the need for interface specialists who are already intrinsic to alliances, have forced the operators to cede some of their authority, not always a bad thing.

***************************************************************************************

And finally…one of my favourite subjects: forecasting. In my early days of covering the oil biz, I went to annual conferences in which OPEC were involved. Every year some learned oil price analyst would tell a rapt audience what the per barrel value would be in the coming year, hoping that everyone would have forgotten what he or she had said the year before, because inevitably they were wrong. How could it be possible to predict the price of a commodity – any commodity – in which there were so many possible variables outside your influence. One might as well stick a damp finger in the air.

So it is with peak oil. We have been told any number of times that we have come to the period of maximum production, only for there to be another new province to burst forward. So it has been with the deep offshore Angola, the recovery of the Gulf of Mexico, onshore shale in the USA and now the eastern Mediterranean. It is only gas to date, but who is going to bet against oil production there as well.

What seems to be of more significance is peak demand. Are you going to bet on when that will be when one has to add in the permutations of the Chinese economy, the rise of renewables in response to global climate change, the general increase in pollution that is affecting major metropolitan areas, the rise of new consuming economies in Africa and Asia, et al. I offer the opportunity to bet your home on it. Any takers?