I had such a a good chuckle a week or two back that I could not resist commenting on. Please indulge me.

The offshore oil and gas supply and service sector has had a long history of bad names. Some of the less than glorious monikers tagged onto companies have included Acergy, Acteon, Valaris, and, my favourite least favourite, Rockwater. When I was editor of Subsea Engineering News, I was invited to the launch of the new company in Aberdeen after the merger of Halliburton’s subsea assets – Wharton Williams and some parts of Brown & Root – with Smit’s offshore marine division (I think those are the companies which were involved, but happy to be corrected) back in the early 1990’s. It was quite the palaver. Dick Morris, who was chairman of B&R at the time, appeared on a stage as if from a cloud, surrounded by gases from dry ice, and proudly announced that the name of the merged entity was going to be ‘Rockwater’!

I was sitting at a table with some management folk including Steve Pywell who I believe was to be commercial director of the new company. I looked over at him quizzically and said, ‘Rockwater?’ He shrugged his shoulders and, looking sheepishly, said, ‘It had nothing to do with me.’ I was later told that the new company had spent a fair amount of money on the rebranding, which would not sound like a lot of money now, but probably seemed like a good deal 30 years ago.

I was reminded this week of this incident when Airborne Oil & Gas, the manufacturer of composite pipe, announced that it had undergone a re-branding and it was now to be known as Strohm. I will be the first to admit that Airborne was a name that never seemed to have much connection with its new product – what was airborne about it has never been explained – but Strohm seems even more inexplicable unless that is the name of the boss.

Martin Van Onna has been with the company on the marketing and commercial side since it took its first baby steps. I sent him a note saying I hoped they had not spent too much money with a branding specialist to produce such an ‘unmemorable’ name. His reply was that my comment was ‘memorable’. Sounds like he must not be too thrilled.

*************************

While I have your attention, I thought I might say something on another subject: the appearance of propriety. A fortnight ago, TechnipFMC announced that it had named Margareth Ǿvrum to its board. Ms Ǿvrum, a long time member of the management team at Equinor-cum-Statoil as head of technology and projects, had moved to Rio a few years ago to look after the company’s now big holdings in Brazil. I have met Ms Ǿvrum any number of times and I have only the most respect for her and am not casting any aspersions on her integrity nor that of Equinor, but…

How can the other players in the subsea equipment market feel when they see a member of Equinor’s senior management sitting on the board of one of its competitors? I can not imagine it sits easily, but who has the nerve to complain? What I did not know when I first started writing this is that Ms Ǿvrum announced her retirement from Equinor two weeks before the TechnipFMC announcement, although she does not leave officially until 1 January 2021.

What I also did not know at the time was that she has also been a board member of Alfa Laval, Atlas Copco and at least one other company whose name is unfamiliar to me. I asked Equinor to explain its corporate rules about senior management sitting on the boards of supply sector companies. This is what the company said:

‘Equinor’s code of conduct states that before accepting external directorships or other material assignments, one must obtain prior written consent from their senior vice president or, for any employees above this level, their leader. Any directorships must be registered with Equinor and be updated on a continuous basis.

‘If offered an external board membership in a company that might bring one into an actual or perceived conflict with Equinor’s interests, this should be discussed openly with one’s immediate leader and with our legal department before accepting such external board position. An assessment has been made in this specific case and given that Margaret Øvrum is retiring from Equinor in just a few months and will not take part in any decisions related to TechnipFMC until then it was concluded that this was within our guidelines.’ When asked asked about the other directorships, I was told that the same rules apply.

I asked a few other folk who have worked for big operators about their company rules. One told me usually the rule is to avoid companies in the same sector, although senior people are encouraged, as part of their development, to take non-executive directorships as long there is no conflict of interest. Another former operator bod said that there is one rule for the workers and one for senior management who apparently can do just about what they like.

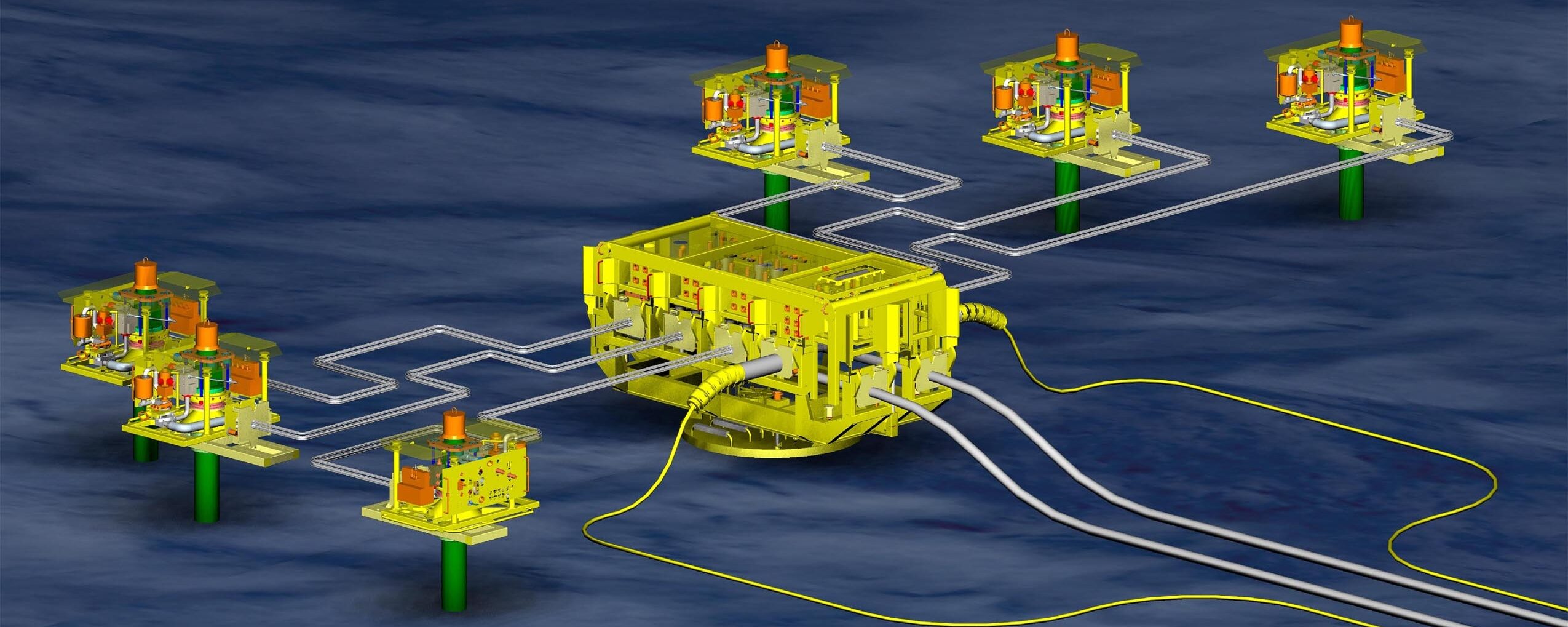

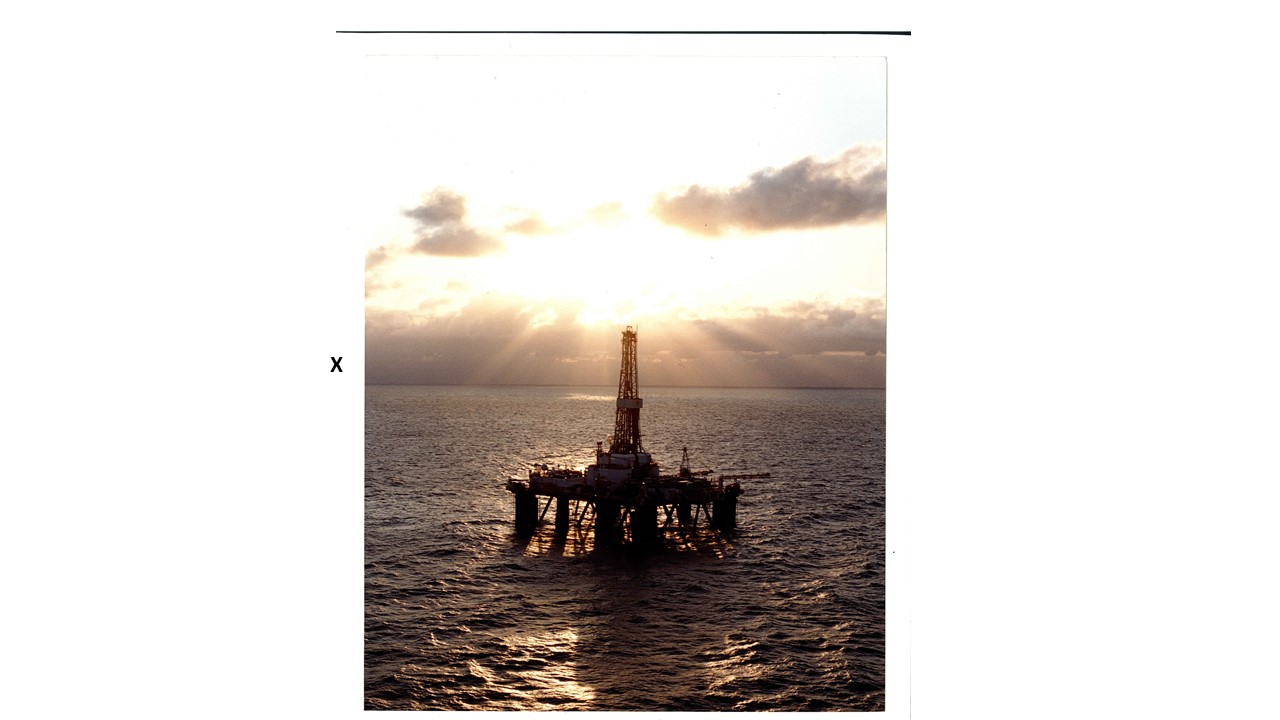

I guess it just seemed a bit cosy to me, particularly as there is a considerable and ongoing relationship between Equinor and TechnipFMC. This reminded me of a story I was told by someone I knew when the company was simply FMC. Some long time ago, late 1990’s or early 2000’s, members of FMC’s management, before it gained its dominant position in the subsea equipment market, had a powwow with some of Statoil’s subsea team and asked where it should direct its technology development. Statoil reportedly suggested subsea processing, subsea well intervention and a third area which I don’t recall. FMC took this advice and also focussed on establishing frame agreements with some of its big customers, including Statoil-cum-Equinor, Woodside, Anadarko, et al. So these guys know each other really well and assuredly are on each other’s xmas tree – oh I meant Christmas card – list.

I would have thought that there needs to be transparency or may there is, as Equinor and my other unnamed former operator employee said it is not a problem as long as their is no conflict. I assumed that these and other companies pay members of their boards at least a nominal sum – but probably quite a bit more – for attending meetings. Now we know that there are rules governing such appointments.