During the first decade of publishing Subsea Engineering News – that is beginnning in 1984 – the North Sea, and the UK sector specifically, was the epicentre of the subsea/floater world. It was not that there was not meaningful activity elsewhere – assuredly the Brazilians were moving slowly, but surely into deeper and deeper waters and dragging technology with them, there was activity in the Gulf of Mexico and our friends across the median line here were just beginning to crank up what would be a burst of activity in the early 1990’s – but many of the reliability, operability, technology and safety issues that were holding back the quicker acceptance of subsea production were being advanced here.

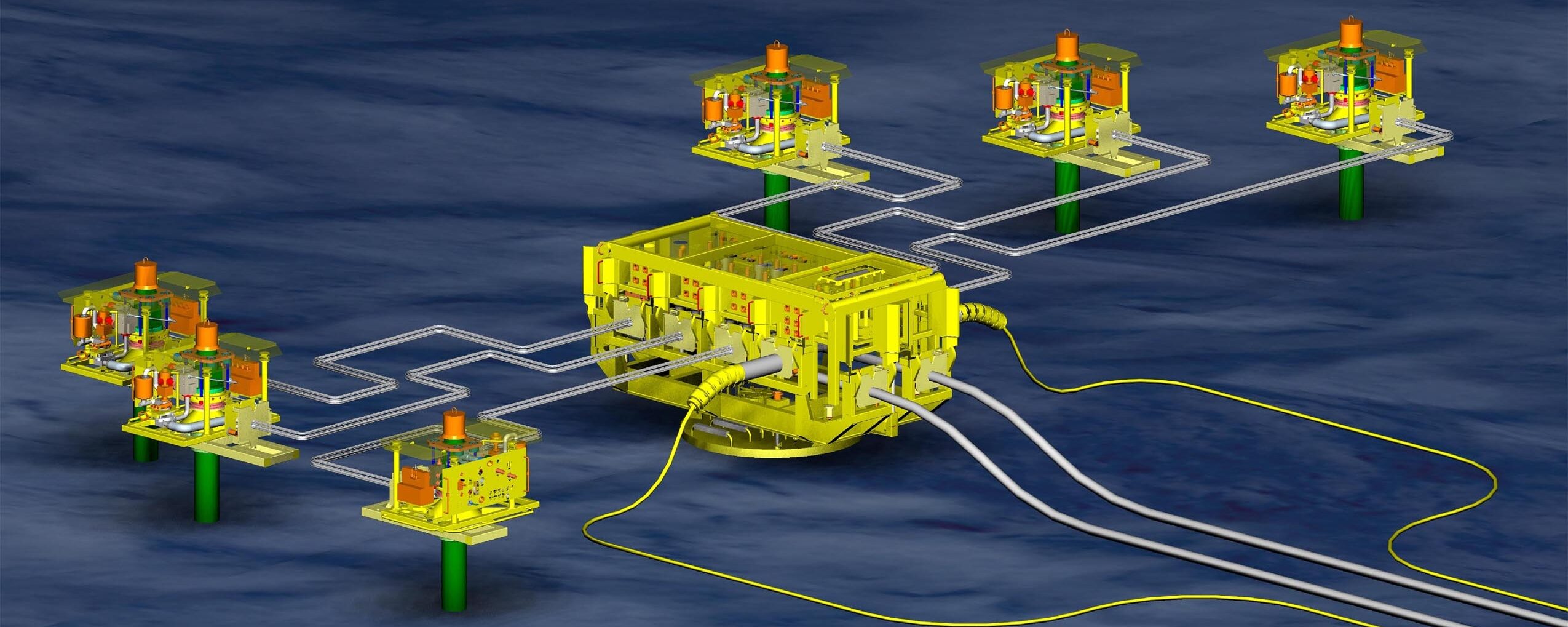

In the years after Shell’s ground-breaking Underwater Manifold Centre at Central Cormorant in the early 1980’s, a number of UK operators took bold steps in deploying subsea production. Texaco/Highlander and Occidental/Scapa were two such examples, while Amerada Hess followed at Rob Roy/Ivanhoe, Scott and Fife/F-fields, the latter bringing the leased fpso – and with it the Hugo Heerema-led Bluewater Energy Services – into the UK market. Kerr-McGee/Gryphon was also in there with a leased fpso, but will be better remembered for the first application of the horizontal xmas tree, or more specifically, Cameron’s SpoolTree. BP should also be mentioned for its West of Shetlands developments even if they did not go as smoothly at the time as this super-major would have liked.

It was mostly downhill from the mid-1990’s as far as the UKCS’ importance to subsea advancement. First it was the GoM at Mensa followed by the inexorable rise in significance of West Africa, both Angola and Nigeria, and Brazil in the pre-salt era.

So what is this all in aid of? Well, last year there was some excitement expressed in various circles about exploration activity on the UKCS plus the ongoing transfer of assets – around $15bn worth – from uninterested majors to the growing number of new independents and increased new licence activity.

All good? Well…there will be a need for these new indies to put up capital to make the growing numbers of tiebacks and new small projects come to life and bring those reported 5bnboe into production. The real ‘big spender’ will be Siccar Point who will throw $2.5bn at the Cambo WoS field. What is more interesting and to put that figure into context is that Equinor is spending $12bn on the Dogger Point offshore wind farm. Who’d have thought it?

A negative point has now come from an unusual source – the Oil & Gas Authority. Former energy minister and now OGA chairman Tim Eggar said this week that everyone involved in the offshore sector, including all operators and service companies and even his organisation, need to focus on the reduction of greenhouse gases and the ‘net zero emissions’ commitment. You could have knocked me over with a feather.

************************************************************************

It is hard to get away from the political and policy issues these days, but here is a bit of notable production/technology news. Gas has started to flow from Noble Energy’s Leviathan deepwater gas field, offshore Israel. The numbers are worth noting: 40mcm/d of production from four subsea wells. That is 10mcm/d per well. If I remember correctly, when Norsk Hydro brought the TOGI project online back in the early 1990’s, it was hailed as one of the biggest with wells flowing at 1mcm/d. What a difference three decades can make.

************************************************************************

I have had many kind comments about SubseaWatcher and how much folks like reading it. So I will be blunt – I need some some support here, folks. A few more sponsors, ie advertisers, on the main page would be extremely helpful.

And FYI, I will be at Subsea Expo on 11-12 February in Aberdeen, so if you want to have a chat or even just to say hi, give me a shout. And HAPPY NEW YEAR to all of you.