When I was offered my first job writing about the energy market way back more than 40 years ago, I had to consider the implications of leaving the world of general journalism to take up a specialist area. (Of course, at that time I never would have dreamed that I would be at it for the rest of my career, but that is the luck of the draw.) What I thought at the time was that if I was to take up writing about a specific area or industry, it had to be a subject of importance to the world at large, ie food, water, or energy, so that is how I ended up where I am today.

It could hardly have escaped your attention, unless you have been doing a Rip van Winkle, that energy has never been more important than it is in the current climate. So pay heed. It is so ironic – or maybe just downright annoying – that just at a time when the world has finally grasped, hopefully not too late, that we need to rearrange our energy priorities, the Russian invasion of Ukraine threw a seriously large spanner (ie monkeywrench in American English) in the works, driving energy prices, primarly natural gas and electricity, to near record highs. While gas prices have fallen recently, it will only take one serious cold snap and they will jump again. And it is quite difficult to interest large portions of the population of the seriousness of the transition away from hydrocarbon-based fuel to renewables and hydrogen when the prospect of being cold this winter is primary in their minds.

A notable point in all of this is the operation of the energy market. Oil and gas prices have always been linked, if not officially at least in the operation of the world of supply and demand. This altered to some extent at the time of North American shale boom in the 2010’s which drove the price of natural gas down. The current issue is the linkage between natural gas prices and those of renewables, primarily wind-generated electricity. Assuredly many of the general public will want to know why electricity prices have shot through the roof when the generators and suppliers have been promoting the fact that wind-produced electricity is now cheaper than from gas-fired power stations.

The answer is to push forward with more wind power which should allow the suppliers to reduce demand for gas and eventually decouple electricity from the price of gas. Of course, this is partially dependent on the government – what government you might ask! – allowing for the installation of onshore turbines which most people would like to see except for the NIMBY Tory voters. The question is whether they will continue to oppose onshore wind turbines when they watch their electricity bills skyrocket. So much to consider and so little time to consider them.

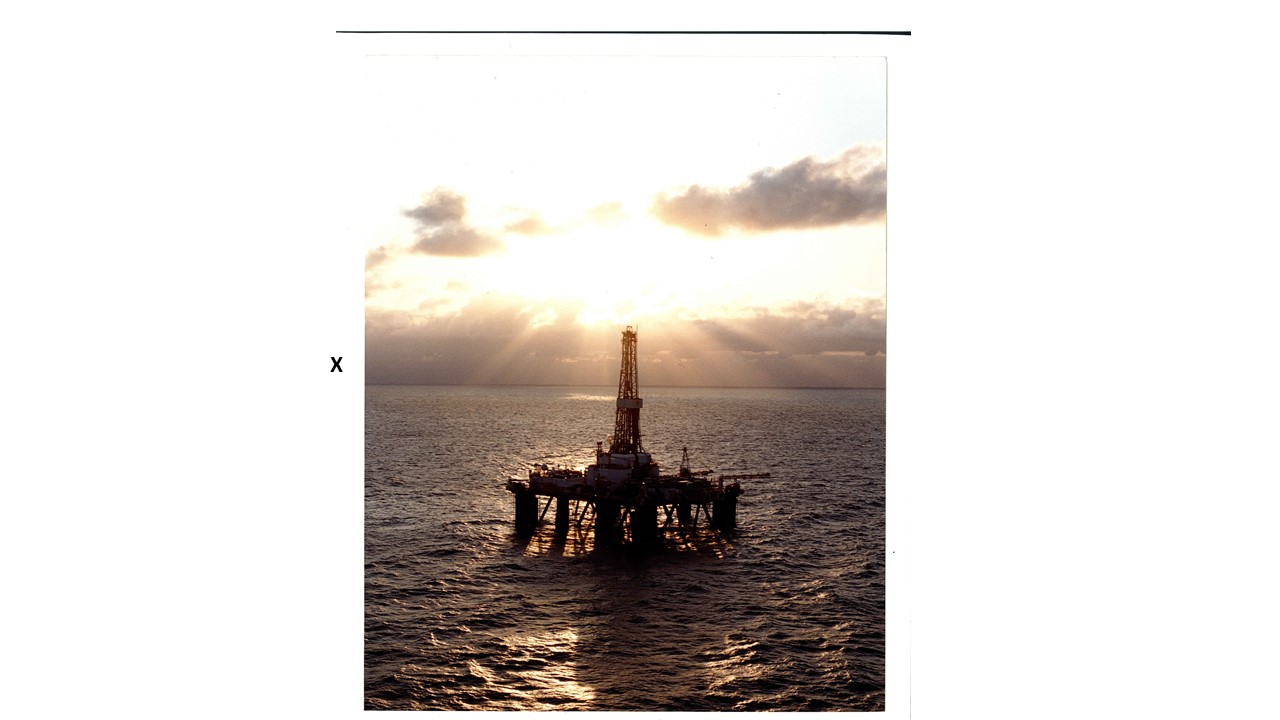

Other points: Offshore Energies UK, the oil company mouthpiece formerly known as Oil & Gas UK, continues to push back against expanding the windfall tax. Somebody has to pay to get us out of this current economic mess and shouldn’t be those who benefited from rising prices? So let the rich and the oil companies pay now. All of us who have been involved with the offshore industry understand the risk and rewards associated with the industry. The rewards have recently outweighed the risks, so time to stick for those who can to stick their hands in their pockets.

And finally: those observant folks will have noticed that some new ads have appeared on the blogsite. I needed to find some way to keep going here, so please have a look at them. It will help.